Introduction

This is an assessment of the amount of retirement corpus required in India when one wants to stop actively working for money. I don't mean retirement as a state of being completely out of work, it is a state where the monetary rewards are not the primary motives for the activities one takes up. This article heavily borrows the ideas from The Trinity Study and adapts them to the Indian context. The idea is simple but it also allows for several risks to be covered by taking appropriate insurances and allowing a small contingency fund that is outside of monthly withdrawals.The Idea

The Trinity Study is based on the analysis that S&P long term returns - Compounded Annual Growth Rate (CAGR) exceeds the inflation by 400 basis points or 4%. If one plans to retire today with a desire to leave a reasonable inheritance, one's corpus needs would be (Current Annual Expenses * 100 / 4). This will ensure that the corpus never depletes to zero even if the monthly withdrawals are inflation-adjusted.In order to arrive at the corpus, one needs to know today's annual expenditure and when one wants to retire. The calculation assumes a certain return from equities, a certain inflation percentage, and proposes 7% as an acceptable withdrawal amount in the Indian Context. This puts the corpus required at (Annual expenses *100 / 7). If you believe that India will move from developing to the developed economy during your retirement, you can either plan to factor 4% or even 3.5% withdrawal rates from the corpus. This simply increases the corpus needs by a factor of 2.

The Data Used

The model is heavily based on the expected returns on the Corpus and the expected inflation.Returns: Nifty returns over the last 19 years (Jan 2001 - Dec 2019) have been used in this computation. This covers two major slowdowns in the stock market one in 2001-02 and the other in 2008-09 and several other short term bear and bull cycles. The choice of this period also excludes the steep rise in stock markets due to the opening up of the economy that happened during the decade before (1990-2000).

Nifty Closing values on 1st Jan 2001 is 1254 and that on 31st Dec 2019 is 12168 from Nifty Historical Data. This translates to a CAGR of 12.7%.

Cost Inflation Index (CII) from the Income Tax Department, Government of India has been chosen as the Inflation index. This has been chosen as it has the base year of 2001-02 which nicely aligns with the Nifty period. CPI and WPI may have been more appropriate but they weren't picked due to changes in the base year and the inherent volatility of those indices. CII for 2019-20 is 289, it implies an inflation CAGR of 5.7% over the last 19 years.

If the withdrawal rate is 7% (12.7%-5.7%) - the corpus will last an eternity as long as the inflation-adjusted annual spend is constant and over a long period (return - inflation) remains constant.

Recommended Corpus

[Conversion: 1 lakh = 100,000 & 1 Crore = 10,000,000 i.e., 10 million. All calculations are in Indian Rupees. As per statistics released by the Income Tax Department for 2018-19, less than 0.2 million (0.34%) individuals among the 58.7 million assesses declared income of more than 5 million rupees. The 3 mil & 4 mil Rupees (30 lakhs and 40 lakhs) used below go a long way with respect to purchasing power in India if major mortgages such as house are paid up]The key input to the calculation of the corpus is the annual expense estimate. IT makes sense to amortize big-ticket replacement costs on an annual basis and include them in the annual expense.

Say you have two cars, costing a total of 50 lakh rupees. You have to replace them after 10 years at a salvage value of 8 lakhs in today's value. You can amortize the 42 lakhs replacement cost over 10 years and add it to your annual expense. That would be around 2.5 lakhs per annum. You can include it in the annual expense and transfer the inflation-adjusted equivalent of 2.5 lakhs each year to a separate fund and withdraw it when it is time to replace.

All major anticipated expenses such as kids' education, marriages, and capital expenses towards the primary home may be amortized as above and included in the annual expense. Wherever there is an option to cover risks by insuring appropriately such as life, health, and property - it has to be used. A small contingency fund to cover expenses beyond insurance limits and covers needs to be planned.

Retiring Today

Corpus required for an annual spend of

- 30 lakhs => 4.3 Cr [calculation: 7% of 4.3 Cr = 30 lakhs]

- 40 lakhs => 5.7 Cr

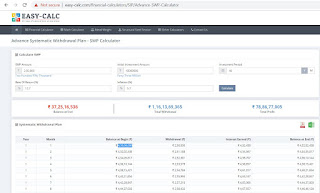

Snippet from easy-calc on SWP (Systematic Withdrawl Plan) from a Corpus of 4.3 Crores with monthly withdrawal starting at 2.5 lakhs and increasing monthly at the inflation rate is below.

Retiring in 10 years

The 4.3 Cr and 5.7 Cr need to be adjusted for 5.7% inflation. So one needs a corpus of 7.5 Cr and 9.9 Cr respectively if one plans to retire after 10 years. In case you want to start at zero today to build 7.5 Cr in 10 years, you need a SIP of 3.1 lakhs per month and for 9.9 Cr, it will be 4.1 lakhs per month.Snippet from SIP Calculator below

* Please note that the above numbers are for the worst-case scenario, the expectation is that one has some retirement corpus and also the mandatory provident fund accumulations are also significant (25 lakhs - 1.5 Cr) during a 10 year period based on your salary and contributions. Additionally, the activities taken up during retirement may also provide some small monetary gain.

Retiring in 20 years

The adjusted Corpus values for 30 lakh and 40 lakh annual expenses are 13 Cr & 17.3 Cr [translating to monthly SIPs of 1.18 lakhs and 1.57 lakhs] respectively. It may be noted that the SIP contributions required are lesser due to longer duration.Possible Extensions

The above one is simplistic in the sense that it factors only stock market returns for both Systematic Investment and Withdrawal. One can extend the concept to have a comfortable representation of equities, debt, return yielding real estate, and other instruments such as gold/silver bars in both accumulation and consumption phases.Several large and mid-cap mutual funds try to and succeed in beating the NIFTY returns. If you factor higher returns, you may need to make lesser monthly contributions to the SIP.

The corpus accumulated in Mutual funds via SIPs may be used to during the withdrawal period by converting into SWP.

Long term capital gains and other taxes are not factored in the above illustration. @10% tax, it is actually 27 lakhs per annum in hand instead of 30 lakhs in the above computation.

There are several articles over the web that study the continued relevance of the trinity study and improve it to include various risks and even recommend reduced withdrawal rates: link.

i dont know about sip calculator please give me information

ReplyDeletehttps://sipplancalculator.com/

DeleteThat is amazing content i am also a investor . I invest different companies as well as worker on sip calculator

ReplyDeletewhat is this SIP calculator ? how to use this

ReplyDelete